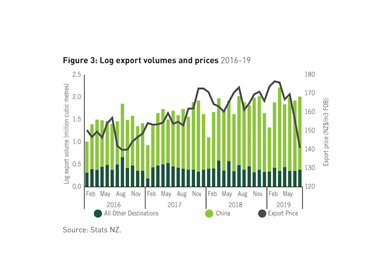

Data from the MPI Situation and Outlook September update shows log export prices have dropped 20 percent from February to July, including 17 percent just from May to July (Free on board basis, Figure 3).

This was caused by several supply-based factors, including a build-up of softwood inventories in China following very high log export volumes from New Zealand. At the same time, supply of logs and sawn timber increased from Europe and Russia.

China’s manufacturing sectors, including furniture, are showing signs of falling demand, but this is not likely to have a direct impact on demand for New Zealand logs. Importantly, Chinese demand in the construction sector, where most of New Zealand’s logs are used, does not show any significant reduction so far as a result of the US-China trade dispute.

Given the current oversupply at Chinese ports, log prices are expected to remain at lower levels over the next several months while high log inventories at Chinese ports gradually dissipate. Harvest volumes in New Zealand have been extremely high in response to previously elevated log prices, with some small woodlots being harvested early to capitalise on strong returns.

Now that prices are much lower, harvest volumes are expected to fall by around 5 percent from the previous year, as smaller forest owners (who currently represent around 40 percent of harvestable volumes) delay harvesting. As a result, log export volumes are expected to fall 9.2 percent in the year ending June 2020.

Source: Ministry of Primary Industries