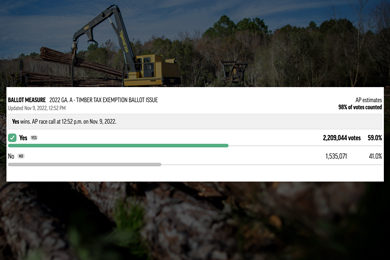

Just recently Georgia voters made a clear statement in support of Georgia’s small forestry businesses that steward the state’s 22 million acres of working forest by passing Referendum A by simple majority. The referendum provides an ad valorem tax exemption for forestry equipment used in tree planting, forest management, and timber harvesting.

The Georgia Forestry Association is pleased that Georgia’s loggers, tree planters, and land managers will be given equal treatment with farm owners and agriculture businesses, who have been extended the same equipment tax exemption for decades. Referendum A was a GFA policy priority that started with strong bipartisan support in the Georgia State Legislature for House Bill 997, sponsored by Rep. Sam Watson (R-Moultrie). This summer, GFA launched a grassroots communications campaign in support of Referendum A, focused on activating members across the state and educating key media outlets across the state.

“We are grateful for the support from the state legislature and more than 2 million voters who voted to help keep Georgia the number one forestry state in the nation,” GFA President & CEO Andres Villegas said. “As we travelled across this state, we’ve heard from hundreds of small forestry businesses about the importance of this legislation, which will deliver much needed economic relief to the forestry supply chain.”

This tax exemption will apply to more than 1,200 small forestry businesses that directly support more than 5,400 jobs across the state. Small forestry businesses are under an extreme amount of economic pressure due to rising operational costs, supply chain constraints and labor challenges. In 2022, logging companies have seen an average cost increase of $2.50/ton of wood harvested, which translates into an estimated $7,500 per week (or $400,000 per year) in increased operating costs for an average small forestry business.

Beginning January 1, 2023, forestry equipment to be exempted from taxes will include equipment owned or held under a lease-purchase agreement. The off-road equipment will include skidders, feller bunchers, debarkers, delimbers, chip harvesters, tub-grinders, wood cutters, chippers, loaders, dozers, mid-motor graders, equipment attachments. The tax exemption does not apply to motor vehicles or trailers.

The Georgia Forestry Association will continue to advocate for healthy regulatory, legal and tax structures that support the state’s working forests and the economic and environmental benefits they provide to our state. To learn more about becoming a member or getting engaged with the Association, visit www.gfagrow.org or contact us at 478-992-8110 or at info@gfagrow.org.