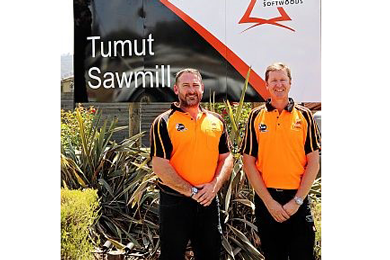

Associated Kiln Driers Softwoods (AKD) has confirmed that it has finalised the purchase of Carter Holt Harvey’s (CHH) New South Wales sawmilling business. The major assets of this business comprise of the Tumut sawmill, Gilmore treatment facility, a 50% interest in the Highland Pine Products (HPP) joint venture in Oberon and a distribution centre in Berkeley Vale.

The Tumut sawmill processes approximately 565,000 m3 of sawlogs producing a range of outdoor and structural products and the Gilmore treatment facility is a value adding site also located in Tumut. The HPP joint venture processes approximately 600,000 m3 of sawlog. All of the nearly 500 NSW employees will continue to be employed by the business.

AKD’s Chief Executive Officer Shane Vicary explains “we are excited to be acquiring the assets and merging the NSW people into our AKD team, the operations are well run and operated by dedicated, talented and passionate people.”

AKD Softwoods is a privately-owned Australian company with a proud history of 60 years in the forest industry, with 55 of those years as softwood sawmillers. From humble beginnings in the regional Victorian town of Colac where the head office remains, AKD as of today will have 12 operational sites across 3 states and employ over 1000 people.

“We are proud of our story, the products we produce and relationships we hold with our customers, employees, suppliers and communities” says Mr Vicary. “We see the NSW business as a strategic fit for the AKD Group as we have a long-term dedication to our industry producing timber products for the Australian market. This opportunity will provide AKD with a larger range and volume of products, and greater flexibility with multiple sites located across the eastern seaboard to offer new and existing customers superior service and supply security”.

This expansion continues AKD’s approach of growth and sustainability through strategic acquisitions and continual capital investment, cementing its commitment to the industry.