In the recent years there has been a marked uptake of remote sensing technologies. Drones and LiDAR have acquired a high profile. These indisputably have a place provided they are cost-effective, deliver consistent results, and add value. Not to go unnoticed, though is the increased availability of satellite imagery and technological advances that allow repeat assessment of forests at low cost. The main catalysts have been the launching of more satellites and the development of cloud-based processing engines. Between them, they can provide near real-time monitoring.

New satellites with the capacity to record and monitor vegetation change are now launched monthly. The so-called temporal resolution has progressed to daily revisits. By monitoring a given location repeatedly, it is then possible to detect subtle changes in vegetation vigour and identify underlying trends.

Any such initiatives do, though come to involve massive data sets. Downloading and storing these for local processing can lead to unworkable delays. A dramatic step forward has come with the availability of cloud computing systems. These allow the petabytes of historical and recently acquired images to remain in the cloud. If the data remains lodged there, it overcomes any need to individually review, download, or process and analyse satellite imagery as was the norm until recently.

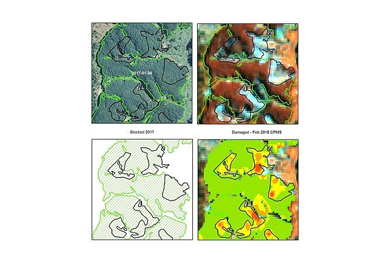

Indufor’s resource monitoring team has developed a Continuous Plantation Monitoring System (CPMS). This can access both free and commercial satellites (such as Planet) to provide timely and accurate information. It has a ready capacity to assess large areas. CPMS assists forest planners in more efficiently deploying field activities, whether their purpose is to grow, harvest or quantify tree crops.

Dr Pete Watt is Head of Indufor’s resource monitoring team. He observes that within the company’s activities the CPMS outputs save time and resources by allowing targeted field inspections. These are designed to quickly validate harvest areas and pinpoint areas of un-mapped change, disease or crop failure.

“For example, before going to the field, we run our Canopy Index (CI) model over the satellite image to check for any unusual deviations from expected benchmark values.” Examples might include areas affected by foliar diseases, or, as shown in the illustration, pockets of wind damage.

Algorithms have been developed to provide automated monitoring of such planned operations as harvesting, roading and plantation thinning. These events can be tracked by comparing images acquired at different points in time. The detection algorithm identifies the change and groups all similar pixels to produce a change layer that can be loaded into a GIS. The outputs include a summary of the area harvested to date.

The inclusion of daily imagery such as from Planet’s constellation of around 200 satellites makes the process of month-end area reconciliations a much less onerous task. The advances in the capture and processing of satellite imagery have removed barriers that have previously discouraged its operational use. CPMS captures the dynamic attributes of forests – the very characteristics that make them so valuable to us.

Indufor Asia Pacific (Pete Watt and Chaplin Chan) will be presenting at the upcoming ForestTECH 2018 series being run for forest resource managers, remote sensing specialists and inventory foresters in November. It runs in Rotorua on 14-15 November and then again in Melbourne, Australia on 20-21 November.

In addition to the technology update from Indufor, presentations from the Interpine Group, Swift Geospatial and Pan Pac Forest Products are being given on the collection, processing and the practical operational use by forestry companies of data being collected from satellites as part of the November series. Full details on the programmes and technology series can be found on the event website, www.foresttech.events.

Source: Indufor