Following on from last week’s analysis of the changes being made in the Russian forestry industry, we include this week a review by WOOD MARKETS on the major cost reductions being seen in Russia and the potential impact that this will have on their log and processed lumber exports.

With major cost reductions arising as a result of the ruble’s devaluation, the Russian industry is now formidable, in stark contrast to the tough situation it faced in 2012–14, e.g.,

– On a U.S.-dollar basis, Russia now has a competitive supply chain in terms of timber harvesting, hauling costs and processing (i.e., larger and more modern sawmills);

– The Russian industry is making high margins and investing in:

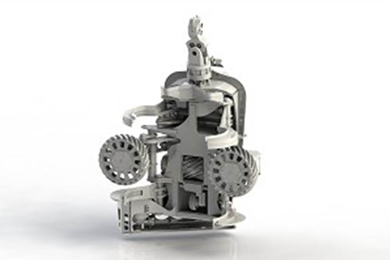

– New, modern logging equipment (typically Scandinavian/some U.S.)

– New, modern sawmill equipment (typically European)

– Value-added: kilns, planers, moulders, etc.

– Logistics costs (within Russia) are also favourable due to the weak ruble. Russian road and rail infrastructure are “okay,” but logistics costs rise outside of Russia (in U.S. dollars); and

– With a weak ruble, the economic log-hauling radius has been expanded to include forests with higher volumes of coniferous timber.

For decades, the economic timber supply in Russia has been moving further away from sawmills: most coniferous forests have been logged heavily and there is a sea of remaining hardwood timber located near sawmills. In addition, no investments have been made in forest roads, leading to steady increases in the hauling distance from forest to sawmill. The situation facing typical Siberian sawmills can be summarized as follows:

2004

– Typical log hauling distance to sawmill: 120–150 km

– Lowest delivered log costs in world = excellent costs at best mills (US$18/m3)

– Sawmills very profitable

2012

– Typical log hauling distance to sawmill: 200 km

– Delivered logs to sawmills dramatically higher (US$60/m3)

– Unfavourable sawmill cost position and weak earnings

2016

– Typical hauling distance: 250 km (including up to 600 km by river)

– Delivered logs to sawmills are now dramatically lower (US$35–$40/m3) at best mills

– Sawmills very profitable

In terms of logistics, Russian log and lumber exporters are able to use the country’s railway system to access markets in China. On the other side of the border, the Chinese government has invested heavily in rail infrastructure at its land ports to accommodate daily trains from Russia carrying logs, lumber, oil and other commodities. This has facilitated rising exports of logs and lumber from Siberia by land. Simultaneously, lumber exports from western Russia by ocean container have increased dramatically since the beginning of 2015.

An export tax on Russian softwood logs (starting at 13% and going up to 25%) has been a major financial incentive for Russian companies to process sawlogs in their own sawmills. In turn, this has driven sawmill investments with an eye to processing more logs with a greater throughput (in an attempt to lower milling costs). As a consequence, more traditional lumber and “squared” lumber (cants) are being exported to China instead of logs (as a means to avoid the export tax). This is highly evident when lumber exports (increased to roundwood equivalent volume) are added to log exports to China. Russia’s total export volume to China is still rising, but comprising more lumber and fewer logs.

The modernization efforts that have facilitated increases in Russian sawmill production have resulted in a greater volume of kiln-dried, planed and higher grades of lumber being shipped to China for further processing. In addition, there have been some huge investments in kilns, planers and remanufacturing equipment to produce more kiln-dried, planed and higher-grade lumber on the Chinese side of the border. This allows Chinese companies to ship higher-valued lumber much further inside China (at cost savings), as opposed to heavy and lower-valued logs or green lumber.

As an example, in Manzhouli at the China–Russia border, an “industrial park” has been constructed that features over 800 kilns to dry Russian lumber before it is shipped onward to destinations throughout China; also planned for this particular industrial park are 300 Chinese sawing lines that will process Russian logs into lumber for further value-added processing. This particular industrial park is just one of several, and more are planned: in fact, some Chinese state-owned companies are looking to integrate their entire supply chain, i.e., from forests in other countries to the end user in China, including processing mills in China and other offshore countries.

Within China, there continues to be an expansion of high-speed passenger rail and freight service. As well, the country is embarking on its Silk Road Belt Plan that will offer improved rail and ocean infrastructure from Europe/Russia to China. This developing project will connect 19 railway lines in Europe and Western Russia with China for land travel, and will also offer an ocean transit time of as little as ten days.

Source: International WOOD MARKETS Group, www.woodmarkets.com