John Deere introduced Intelligent Boom Control for the 1270G harvester and the 8-wheeled 1170G harvester in June at the Elmia Wood trade fair. Now they are introducing a 6-wheeled model of the 1170G harvester as well as the smaller 1070G harvester. At the same time, IBC will be available also for the 1170G harvester.

Precise and smooth work with IBC

IBC is a unique boom control system developed by John Deere. It is not an automatically operating boom extension or damped valves; it is an intelligent control system with sensors that detect the positioning of the harvester head and algorithms that adjust the boom’s trajectory in one continuous, efficient motion. IBC also functions as a platform for new features that facilitate the customer’s work.

Intelligent Boom Control was introduced for John Deere forwarders in 2013. IBC for the 1270G harvester’s CH7 boom was introduced earlier this year, and now this unique feature is available also for the 1170G harvester’s CH6 boom.

With the harvester, IBC operation has been designed to suit the harvester’s work cycle. The boom’s trajectory and operation automatically adjust as the boom is taken to a tree and when the tree is in the harvester head. The operator doesn’t have to move the different sections of the boom individually.

IBC ensures precise operation and efficient practices. The boom’s electronic end damping makes for soft and smooth work, thereby reducing stress on the entire boom. IBC improves work ergonomics and guides the operator in the correct use of the boom, which is directly reflected in the machine’s increased productivity.

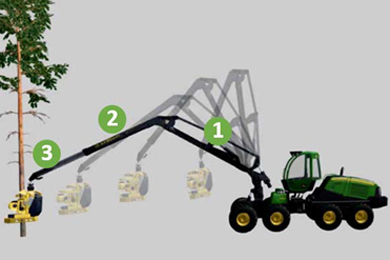

Caption:

The operator maneuvers the harvester head to the desired position and the system automatically adjusts the 1) lift, 2) slew, 3) extension and boom rotation trajectory for the optimal solution.

Design brings comfort to mid-sized G-series harvesters

The 1070G and 1170G models complementing John Deere’s G-Series line of harvesters share a totally new rear chassis and new placement of the engine, hydraulic oil and fuel tanks, and pumps.

In both models the engine has been turned 180 degrees, the hydraulic oil and fuel tanks, and pumps have been placed in front of the engine, and the fan at the rear of the machine. These changes make the cabin very quiet. At the same time, the machine’s rear has been lowered and the rear visibility has significantly improved.

John Deere 1170G meets logging challenges on soft terrain and slopes

The new John Deere 1170G harvester is available in 6- and 8-wheeled version. Updated with many improvements, the 6-wheeled model is a new version of the popular John Deere 1170E harvester. New options for the 6-wheeled model’s front frame are the 24.5- or 26.5-inch tires. The 8-wheeled 1170G is a real general purpose machine for thinnings and regeneration fellings, and for soft terrain and slopes.

The machine combines outstanding stability, low surface pressure, agile forwardmovement, climbing ability on slopes, and excellent productivity.

The bigger 190 cm3 work pump gives the machine more hydraulic power than before. The 1170G model’s CH6 boom is available with a 10-meter or an 11.3-meter reach, and the machine can be equipped with an H412, H413 or H414 harvester head. The weight of the 8-wheeled machine with the H412 harvester head and without tracks is about 19,500 kg, and the 6-wheeled machine with the H412 harvester head about 17,800 kg.

John Deere 1070G is the most agile machine for thinnings

The new John Deere 1070G harvester is ideal for thinning also in fragile terrain. Thanks to its compact, easy to maneuver frame, the machine can also operate in logging areas with dense growth, and the wide tires and balanced frame protect the terrain from damage.

The 1070G model’s 180S boom is available with an 8.6, 10, or 10.8-meter reach, and the machine can be equipped with an H412, H413 or H414 harvester head. The weight of the 6-wheeled machine with the H412 harvester head and without tracks is about 16,000 kg and the 4-wheeled version about 15,200 kg.

Adaptive Driveline Control

Adaptive Driveline Control is a unique standard feature in the G-Series harvesters. The system improves the machine’s drivability and productivity by automatically adjusting the engine’s RPMs to correspond with the engine load. High RPMs are used only when needed, so the machine’s average noise level is also reduced.

During high-load situations, the new Adaptive Driveline Control ensures that the diesel engine runs smoothly and efficiently uses the maximum tractive force available. The response of the drive pedal and frame steering has also been improved with smart electronic filtering.

New fuel efficient engine and easy daily maintenance

The mid-sized G-series harvesters are equipped with the John Deere 6068 engine, which is compliant with the latest Final Tier 4/Stage IV emissions regulations. The more powerful engine combined with the totally new control system make harvester work more precise and efficient and thus increases the machine’s productivity. The Diesel Particulate Filter (DPF) and Diesel Oxidation Catalyst (DOC), and the Selective Catalytic Reduction (SCR) added to the exhaust gas treatment system and the related urea tank, familiar from our previous machines, ensure that our new engines meet emissions standards. The new engine technology has also significantly improved the fuel efficiency of the machines in relation to their productivity.

The daily servicing of the new machine models has been made quicker by making the engine oil dip stick, filling pipe and fuel filters more accessible. The liquid fill connectors have been conveniently placed in one location. The new placement of the batteries also facilitates servicing.

More straight forward machine control

All G-Series machines are equipped with the new MECA control modules, simple CAN busses and optimized electrical system to make the machine functions more efficient. The Processing Power Control (PPC) system adjusts the processing power and fuel economy to correspond with the logging work requirements. The system has three different power levels to choose from, and it anticipates the engine load and responds with the right power boost for that situation, thereby improving both productivity and fuel economy.

1170G

Engine – John Deere 6068, Final Tier 4 / Stage IV

Maximum power @ rpm 155 kW (208 hp) @ 1900

Torque @ rpm 978 Nm @ 1500

Power train – Tractive force, 8W: 160 kN, 6W: 150 kN

Work hydraulics – Pump capacity 190 cm3

Boom – John Deere CH6, Maximum reach 10/11.3 m

Lifting torque 165 kNm

Cabin – Rotating and levelling, or fixed

Harvester heads -John Deere H412, H413, H414

Measurements

6W

Length 7240 mm

Width with 650-Series tires 2720 mm

Ground clearance, at middle joint 580 mm

Weight with harvester head [H412] 17800 kg

8W

Length 7450 mm

Width with 650-Series tires 2720 mm

Ground clearance, at middle joint 580 mm

Weight with harvester head [H412] 19500 kg

1070G

Engine – John Deere 6068, Final Tier 4 / Stage IV

Maximum power @ rpm 135.5 kW (208 hp) @ 1900

Torque @ rpm 850 Nm @ 1500

Power train – Tractive force 130 kN

Work hydraulics – Pump capacity 160 cm3

Boom – John Deere CH6, Maximum reach 8.6/10/10.8 m

Lifting torque – 143 kNm

Cabin – Rotating and levelling, or fixed

Harvester heads – John Deere H412, H413, H414

Measurements

4W

Length 6500 mm

Width with 600-Series tires 2600 mm

Weight with harvester head [H412] 15200 kg

6W

Length 6990 mm

Width with 600-Series tires 2660 mm

Weight with harvester head [H412] 16000 kg

Further information:

Elina Suuriniemi

John Deere Forestry Oy

Tel. +358 400 466 476

SuuriniemiElina@JohnDeere.com