More than 380 million tons of plastic are produced each year, far surpassing most other man-made materials. It can take thousands of years for plastics to degrade due to the stable long polymer chains. Roughly 12 million metric tons of plastic waste will be in landfills, or in natural environment by 2050,causing severe environmental pollution (i.e., ‘white pollution’). More seriously, large numbers of plastic are slowly degraded and then converted into millions of microplastic pieces (millimeters or smaller in size) in the oceans and soil, posing a significant threat to numerous organisms.

In the interest of decreasing this threat, a University of Maryland (UMD) research team led by Liangbing Hu — a Herbert Rabin Distinguished Professor in the UMD Department of Materials Science and Engineering (MSE) and the founding director of Center for Materials Innovation (CMI) — recently developed a simple yet cost-effective in-situ lignin regeneration approach to synthesize a strong, large-scale, hydrostable, biodegradable and recyclable lignocellulosic bioplastic, produced 100% from an abundant and inexpensive wood powder, which is generally discarded as waste. The study, entitled, “A strong, biodegradable and recyclable lignocellulosic bioplastic,” was published in Nature Sustainability on March 25.

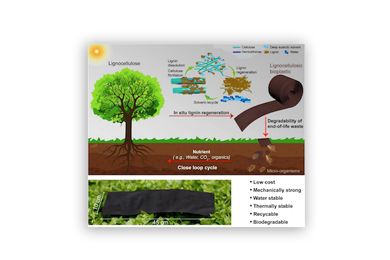

In the fabrication process, the porous structure of natural wood is deconstructed to form a homogeneous cellulose-lignin ‘soup’ that features nanoscale entanglement and hydrogen bonding between the regenerated lignin and cellulose micro/nanofibrils. Large-scale lignocellulosic bioplastic films can then be fabricated by simply casting the cellulose-lignin soup into a mold. Unlike most petrochemical plastics, this bioplastic can be broken down by microorganisms in soil, which offers an attractive closed loop cycle feature (see Figure). Additionally, the material is strong and robust, demonstrating a unique balance between degradability and durability, which neither conventional plastics nor hydrophilic cellulose consumer products can provide.

“We also noted the lignocellulosic bioplastic can be made from various biomass feedstocks, such as grass, wheat straw and bagasse, suggesting the broad applicability of the treatment process,” said Hu. “This strong, water-stable, biodegradable and recyclable lignocellulosic bioplastic with a substantially reduced environmental waste footprint is a strong candidate for replacing widely used petrochemical plastics toward sustainable applications.”

Photo: The preparation of high-performance lignocellulosic bioplastic and its degradation, resulting in a close loop cycle.

Credit: Qinqin Xia for the University of Maryland, College Park.